montana sales tax rate on cars

In addition to taxes car purchases in Pennsylvania may be subject to. It should be noted that the local tax is only applied to the first 5000 dollars of the cost of the vehicle.

Montana Llc Why You Should Register Your Car Or Rv In Montana 5 Star Registration

Hawaii has a higher state sales tax than.

. Counties and cities can charge an additional local sales tax of up to 7 for a maximum possible combined sales tax of 11. Groceries and prescription drugs are exempt from the Colorado sales tax. The Kentucky sales tax rate is 6 as of 2022 and no local sales tax is collected in addition to the KY state tax.

Connecticuts sales tax rates for commonly exempted items are as follows. Are charged at a higher sales tax rate. Select city then click both city and county box.

Puerto Ricos sales tax rates for commonly exempted items are as follows. The Louisiana state sales tax rate is 4 and the average LA sales tax after local surtaxes is 891. Oklahoma has 762 special sales tax jurisdictions with local sales taxes in addition to the state sales tax.

Groceries are exempt from the Louisiana sales tax. Colorado collects a 29 state sales tax rate on the purchase of all vehicles. Oklahoma has a lower state sales tax.

2 county rate city rate total. The Arkansas state sales tax rate is 65 and the average AR sales tax after local surtaxes is 926. Montanas sales tax rates for commonly exempted items are as follows.

The Idaho state sales tax rate is 6 and the average ID sales tax after local surtaxes is 601. Uruguay Sustainable Bond Framework. California has the highest base sales tax rate 725.

The Connecticut state sales tax rate is 635 and the average CT sales tax after local surtaxes is 635. The DE sales tax applicable to the sale of cars boats and real estate sales may also vary by jurisdiction. November 24 2022 4.

Prescription Drugs are exempt from the Arkansas sales tax. Alaska Delaware Montana New Hampshire and Oregon do not levy. Some dealerships may also charge a 113 dollar document preparation charge.

Counties and cities in Washington also collect sales taxes which apply to vehicle purchases and leases so the total sales tax you pay will also include from 05 to 35 of additional local sales taxes based on your local sales tax rate. For vehicles that are being rented or leased see see taxation of leases and rentals. Thus vehicle sales taxes in Washington can range from 73 to 103 based on where the transaction is made.

September 26 2022 4. In the table below we show the car sales tax rate for each state. Kentuckys sales tax rates for commonly exempted items are as follows.

Including city and county vehicle sales taxes the total sales tax due will be between 3375 and 4 of the vehicles purchase price. The CT sales tax applicable to the sale of cars boats and real estate sales may also vary by jurisdiction. Illinois has a lower state sales tax than 808 of.

Are charged at a higher sales tax rate. Counties and cities can charge an additional local sales tax of up to 71 for a maximum possible combined sales tax of 10. Add city plus county plus state car tax for total.

However it must be noted that the first 1500 dollars spent on the vehicle. Average DMV fees in Maryland on a new-car purchase add up to 105 1 which includes the title registration and plate fees shown above. The Hawaii state sales tax rate is 4 and the average HI sales tax after local surtaxes is 435.

Car Tax Rate Tools. Illinois has 1018 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. Counties and cities can charge an additional local sales tax of up to 25 for a maximum possible combined sales tax of 10.

This page covers the most important aspects of Oklahomas sales tax with respects to vehicle purchases. Luca Failla launches a New Boutique to confront a new era for Workplace Law in Italy. The MT sales tax applicable to the sale of cars boats and real estate sales may also vary by jurisdiction.

Counties and cities can charge an additional local sales tax of up to 05 for a maximum possible combined sales tax of 45. Such as used cars the sales tax can be charged on the same item indefinitely. Colorado has 560 special sales tax jurisdictions with local sales taxes in.

The PR sales tax applicable to the sale of cars boats and real estate sales may also vary by jurisdiction. Counties and cities can charge an additional local sales tax of up to 65 for a maximum possible combined sales tax of 11. The Illinois state sales tax rate is 625 and the average IL sales tax after local surtaxes is 819.

Arkansas has 644 special sales tax jurisdictions with local sales taxes in addition to the. Dealerships may also charge a documentation fee or doc fee which covers the costs incurred by the dealership preparing and filing the sales contract sales tax documents etc. Idaho has 12 special sales tax jurisdictions with local sales taxes in addition to the state sales.

The Oklahoma state sales tax rate is 45 and the average OK sales tax after local surtaxes is 877. Vermont was the most recent state to impose a sales tax in 1969. Prescription Drugs are exempt from the Idaho sales tax.

56 county. However a county tax of up to 5 and a city or local tax of up to 8 can also be applicable in addition to the state sales tax. Counties and cities can charge an additional local sales tax of up to 55 for a maximum possible combined sales tax of 12.

Florida collects a 6 state sales tax rate on the purchase of all vehicles. The Puerto Rico sales tax rate is 6 as of 2022 with some cities and counties adding a local sales tax on top of the PR state sales tax. The KY sales tax applicable to the sale of cars boats and real estate sales may also vary by jurisdiction.

Select Community Details then click Economy to view sales tax rates. The Montana sales tax rate is 0 as of 2022 and no local sales tax is collected in addition to the MT state tax. The maximum tax that can be owed is 525 dollars.

The sales tax rate for Allegheny County is 7 and the sales tax rate in the City of Philadelphia is 8. Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles. Are charged at a higher sales tax rate.

Double exemption to spouses living in two different municipalities. However the total sales tax can be higher depending on the local tax of the area in which the vehicle is purchased in with a maximum tax rate of 15. Delawares sales tax rates for commonly exempted items are as follows.

The 1930s six in the 1940s five in the 1950s and eleven in the 1960s. California has 2558 special sales tax jurisdictions with local sales taxes in. Counties and cities can charge an additional local sales tax of up to 35 for a maximum possible combined sales tax of 975.

Counties and cities can charge an additional local sales tax of up to 25 for a maximum possible combined sales tax of 85. Find the latest US. Alabama collects a 2 state sales tax rate on the purchase of vehicles which includes off-road motorcycles and ATVs.

The Delaware sales tax rate is 0 as of 2022 and no local sales tax is collected in addition to the DE state tax. The Colorado state sales tax rate is 29 and the average CO sales tax after local surtaxes is 744. Read breaking headlines covering politics economics pop culture and more.

The California state sales tax rate is 75 and the average CA sales tax after local surtaxes is 844. Maryland Documentation Fees. Hawaii has 69 special sales tax jurisdictions with local sales taxes in addition to the state sales tax.

Louisiana has 667 special sales tax jurisdictions with local sales taxes in addition to the state. Groceries and prescription drugs are exempt from the California sales tax. IMU Municipal Property Tax on first house.

However the car sales tax varies by state and some states dont even charge tax. These fees are separate. Most states in the US charge sales tax on cars.

You Can Avoid Taxes On Your New Car Although It S Risky Business Feature Car And Driver

Montana Car Registration 7 Of The Biggest Benefits In Montana For 2022

Car Leasing And Taxes Points To Ponder Credit Karma

:max_bytes(150000):strip_icc()/best-and-worst-states-for-sales-taxes-3193296_final_CORRECTED-4d56f8efcd264f53981a40415c0e6de3.png)

The Best And Worst States For Sales Taxes

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

How To Qualify For The Vehicle Sales Tax Deduction Carvana Blog

Why Do So Many Supercars Have Montana License Plates Bloomberg

Is Buying A Car Tax Deductible In 2022

Here S Why So Many Exotic Cars Have Montana License Plates Autotrader

Dmv Fees By State Usa Manual Car Registration Calculator

Save Money On Sales Tax With A Montana Registered Agent

Why Do So Many Supercars Have Montana License Plates Bloomberg

What S The Car Sales Tax In Each State Find The Best Car Price

Think Twice About Registering Rv In A Montana Llc Rv Tailgate Life

Sales Taxes In The United States Wikipedia

Montana Llc Rv Titling Tax Avoidance Or Tax Evasion Rv Lifestyle

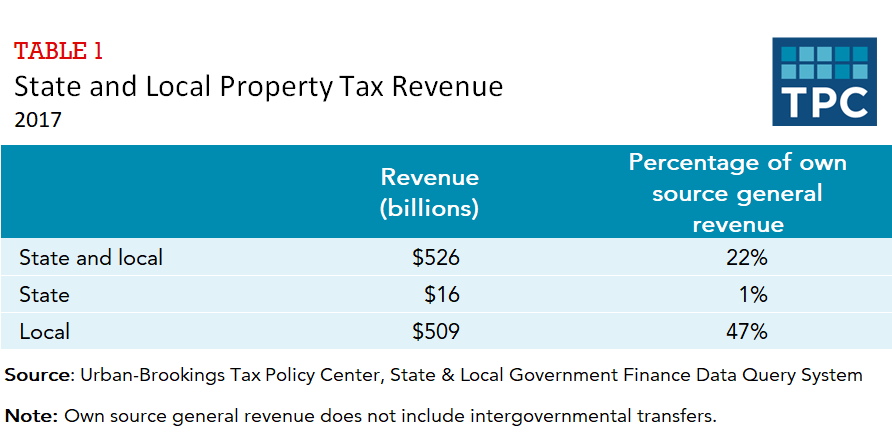

How Do State And Local Property Taxes Work Tax Policy Center

Sales Tax Definition How It Works How To Calculate It Bankrate

Do You Have To Pay Taxes When You Buy A Car Privately Privateauto